Technology has made it a vital part of society to use technology to improve financial services. Although fintech has made financial services more available, it also raises questions regarding consumer protection. Gensler presented a timeline for financial industry innovation as the nominee of the SEC to head the agency. According to Gensler, the concept of financial technology (or fintech) dates back to the creation of money itself.

Fintech is a portmanteau for "financial technology"

Fintech can be described as any technology that delivers financial services. This includes online banking and cryptocurrencies. It also allows you to check your savings account. Fintech is a complex term, difficult to define and controversial in origin. Word Spy claims the term was first used in mass media by Peter Knight (editor of the Sunday Times), on August 11, 1985. Many believe that this term originated in the banking sector, where it was used to transfer international money through the SWIFT program.

Fintech has revolutionized the financial services industry. It has also changed how consumers shop for coffee and manage finances. Fintech was initially used to describe technologies that were used to back up traditional financial institutions. However, today, it is now being used to cover consumer-facing apps or services. Fintech will help people manage their finances, purchase stock, pay bills and even buy food in the future.

It's the integration of technology in offerings by financial service companies

Today's financial service providers are seeking new technology to improve their speed, efficiency, as well as the overall customer experience. Companies have been looking for new ways to make digitalization of banking technology a part of their business process transformation. These tools allow companies offer new products, services, and innovations based on goods movement tracking, on-demand liquidity, as well as smart contracts.

Financial technology isn't a new idea, but it has changed dramatically over the last decade. Technology's advancements have enabled upstarts to make use of technology to cut costs and improve service delivery. Since the 1960s when automated teller machines (ATMs), were introduced, financial institutions have been trying to incorporate technology in their offerings for decades. Similarly, credit cards predate ATMs, but are still revolutionizing the way we pay for services.

It has made financial service more accessible to more people

Digital transformation in financial services has allowed millions of new users to access them, making it possible for them to take part in the global economy. According to the World Bank, people in 140 countries now use online payments to manage their money. These new possibilities for financial inclusion have created challenges, but they also offer opportunities.

One example of financial innovation is mobile banking. These applications allow consumers to make and receive money from their bank account, without having to visit the bank. You can also deposit checks from your smartphone.

It has raised concerns regarding consumer protection

As digital banking has grown in popularity, consumers have a greater need for protection. Digital banking requires consumers to provide personal data that financial institutions can use for marketing, identity verification, and credit approval. This is a very useful tool but it can also increase the risk of data breaches and hacking. Recent hacks of credit card companies and banks have demonstrated that these systems are highly vulnerable to hackers. It is important that consumers ask about the potential risks and verify whether the fintech companies dealing with them have committed to protecting the personal data of their clients.

Consumer protection agencies must be flexible enough so that they can accommodate financial technology industry changes. As consumers have access to more types of financial products, regulation now includes cross-cutting concerns like data accessibility and security. Digitalization has led to a greater number of services and products available to consumers. This creates new risks that must be addressed, and a need to review current consumer protection rules.

FAQ

What types of jobs are available as a consultant?

A job as a consultant requires you to have an excellent understanding of business strategy and operations. Understanding how businesses work and their place in society is also essential.

To be successful as a consultant, you must have strong communication skills and an ability to think critically.

Consultants should be flexible because they may be asked for different tasks at various times. Consultants should be able to quickly change their direction if necessary.

They must be prepared to travel extensively for the clients they represent. This kind of work can take them around the world.

They should also be able manage stress and pressure. Sometimes consultants are required to meet tight deadlines.

Consultants are often expected to work long hours. This can mean you might not always receive overtime compensation.

Is consulting a real job?

Consulting isn't just a career option for those who want to earn quick money. It's also a great place to gain valuable skills and build a foundation you can use in your future work.

Consulting can offer many career opportunities, such as project management and business development. You could find yourself working with small start-ups and large international corporations.

Consulting allows you to learn and improve your skills while also gaining experience in many industries. This could include learning to manage teams and write proposals, manage finances, analyze data, create presentations and conduct market research.

What are some of the advantages to being a Consultant?

Consultants can often choose the hours and topics they work on.

This allows you the freedom to work wherever you like, whenever you want.

This allows you to easily change your mind and not worry about losing your money.

Finally, your income can be controlled and you can set your own hours.

Why would a company hire consultants?

Consultants offer expert advice to help improve your business' performance. They don't sell products.

Consulting helps companies make better decisions. They provide sound analysis and offer suggestions for improvement.

Consulting often works closely with senior management teams in order to help them understand the steps they must take to succeed.

They offer leadership coaching and training to help employees reach their full potential.

They can help businesses reduce costs, streamline processes, and increase efficiency.

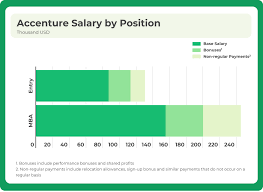

What is the average salary of a consultant?

Although some consultants can make more than $100k annually, the majority of consultants earn between $25-$50k. An average consultant salary is $39,000 This includes both hourly and salaried consultant.

Salary depends on experience, location, industry, type of contract (contractor vs. employee), and whether the consultant has his/her own office or works remotely.

How do I choose the right consultant?

There are three major factors you should consider:

-

Experience - How skilled is the consultant? Are you a beginner or an expert? Does her resume show that she has the necessary skills and knowledge?

-

Education – What did the person learn in school? Did he/she study any relevant courses after graduating from high school? Can we see evidence of that learning in the way s/he writes?

-

Personality - Are we attracted to this person? Would we like him/her to work with us?

-

These questions can help you determine whether the consultant is right for your needs. If the answers to these questions are unclear, it might be worth a first interview to get more information about the candidate.

Statistics

- "From there, I told them my rates were going up 25%, this is the new hourly rate, and every single one of them said 'done, fine.' (nerdwallet.com)

- My 10 years of experience and 6-step program have helped over 20 clients boost their sales by an average of 33% in 6 months. (consultingsuccess.com)

- According to IBISWorld, revenues in the consulting industry will exceed $261 billion in 2020. (nerdwallet.com)

- 67% of consultants start their consulting businesses after quitting their jobs, while 33% start while they're still at their jobs. (consultingsuccess.com)

- WHY choose me: Why your ideal client should choose you (ex: 10 years of experience and 6-week program has helped over 20 clients boost their sales by an average of 33% in 6 months). (consultingsuccess.com)

External Links

How To

How can I start an advisory business with no money?

You can easily start your own consultancy business with no capital investment.

In this tutorial, you'll learn how to make money online while working from home, improve your skills, earn some extra cash, and become successful.

I'll be sharing some secrets on how to get traffic on the demand, especially for people searching for specific items.

This method is known as "Targeted Traffic". This is how this method works...

-

Find out what niche you want.

-

Research which keywords people use to find solutions on Google.

-

Write content that uses these keywords.

-

Post your articles on article directories.

-

Promote your articles using social media.

-

Build relationships with influencers and experts in that niche.

-

Get featured on those blogs and websites.

-

Sending emails can help you grow your email list.

-

Get started making money.